Overview of climate finance

Renewable energy and energy efficiency are significant use areas of the climate finance (see sectors “Energy systems” for RE and “Building & Infrastructure” for EE, respectively, in Figure 1).

Figure 1: Global climate finance landscape in 2021/2022[1]

Climate finance is on the rise (as shown in Figure 2). Despite the recent growth, current global climate finance flows represent about only 1% of global GDP.

Figure 2: Global climate finance in 2011-2022, biennial averages

Source: Climate Policy Initiative

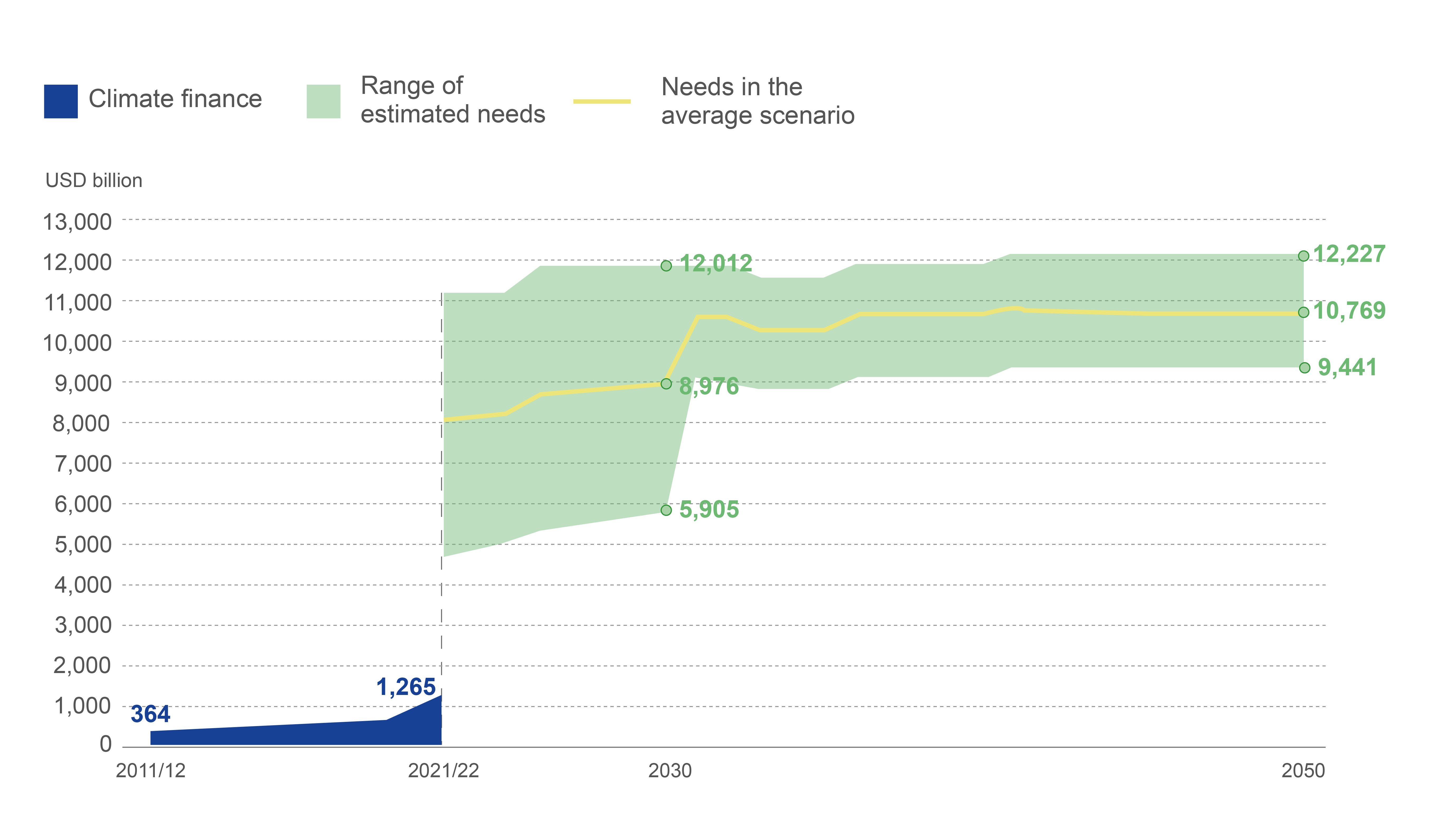

However, growth is not sufficient (see Figure 3), nor consistent across sectors and regions.

In 2021/2022, USD 209 billion, or just over 16% of global climate finance, flowed to least developed and developing countries (excluding China). While not responsible for high emissions historically, least developed and developing countries are disproportionately vulnerable to the impacts of climate change and face substantial related funding challenges.

Figure 3: Global climate finance and estimated annual needs through year 2050

Source: Climate Policy Initiative

Source: Climate Policy Initiative

Climate finance and energy transition investments are inherently complex, multifaceted and have to consider specific factors:

- Technology maturity: newer technologies may involve higher investment risks due to uncertainties in performance and cost

- Regulatory environment: government policies, incentives, and regulations significantly impact the feasibility and attractiveness of energy transition projects

- Project scale and risk profile: large-scale infrastructure projects have higher upfront costs and potentially longer timelines compared to smaller, distributed energy solutions

- Financing options: financing instruments used (loans, grants, guarantees) influence the cost of capital and project risk allocation between investors, project developers and end-users

- Social and environmental considerations: lack of awareness and skills, land use issues, community impacts and environmental regulations add complexity to project development.

These factors may create barriers and risks that hinder faster deployment and scaling up of RE and EE investments.

[1] Link to interactive infographic: