International financing of energy transition in developing countries

Governments and international donors play major roles in enabling investments in RE and EE, especially in developing countries, where actual or perceived risks contribute to the high cost of financing and prevent projects from seeing the light of day.

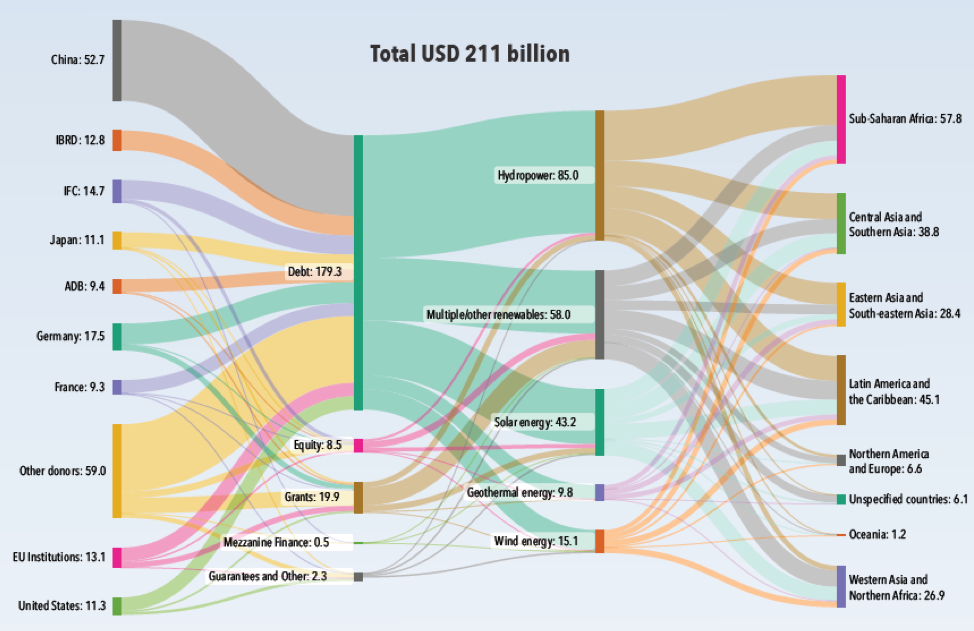

Figure 8 below provides the breakdown of public financial flows to RE sub-sectors of developing countries in 2000-2021.

Most international public flows to RE of developing countries since 2000 have come from China, followed closely by Germany, the International Finance Corporation (IFC), EU institutions, the International Bank for Reconstruction and Development (IBRD), the United States, Japan, the Asian Development Bank, and France. Together, these nine donors account for three-fourths of all funding.

Debt instruments (including market-rate loans, concessional loans, bonds, and other debt securities) have been the primary financial instrument accounting for 85% of total flows. Debt finance is common, because RE and EE investments tend to be capital-intensive, with a fixed element in the cost and revenue structure of the underlying asset. RE and EE projects require high initial capital expenditure and are often underpinned by long-term power purchase contracts, savings-sharing agreements or regulated remuneration.

Grants are the second-largest instrument. Although they make up less than 10% of flows, they play a key role in both funding projects and helping attract private capital. Going forward, grants, concessional debt financing (denominated in local currencies) and other innovative, non-debt funding mechanisms can help meet the financing needs of developing countries while ensuring that these flows do not increase their debt burden.

Figure 8: International public flows to RE of developing countries by donor, financial instrument, technology and recipient region, 2000-2021 (sizes of the channels are proportional to the flow amounts, shown as values in 2020 USD billions)

Source: IRENA and OECD

However, the international flow of public finance directed to RE globally is clearly insufficient:

- Multilateral and bilateral DFIs together provided less than 3% of total RE investments in 2020

- Grants and concessional loans amounted to just 1% of total RE financing.

In recognising the above, IRENA (International Renewable Energy Agency) and CPI (Climate Policy Initiative) propose to prioritise the following:

- Stronger role for public and concessional financing in energy transition investments is necessary

- To meet the needs, the ratio of public-to-private investment must further grow

- Substantial increase in financial flows to the developing countries – from the Global North to the Global South – is required

- More funds need to flow to less mature technologies and to sectors beyond power (e.g. energy efficiency, heating and cooling, transport and system integration)

- Financial institutions and mechanisms which provide lending to developing nations must be expanded and reformed to reduce the cost of capital and ensure private capital mobilisation for RE and EE projects

- Greater use of concessional guarantees, local currency lending and hedging instruments, bankable project development and bundling facilities, blended finance solutions is needed.