Financing instruments

The regularly-used financial instruments are:

The selection of instruments depends on the viability of the technology being deployed and the market barriers and risks that need to be addressed:

- Concessional loans are generally used for energy transition investments that:

- have high costs for deployment

- cannot compete with existing technologies

- have limited operational experience

- face market and financing barriers that hinder large-scale implementation

- Risk guarantees are an effective mechanism when the commercial financing sources have a perception of high risk with respect to proposed investment. The guarantee reduces this risk perception and facilitates commercial financing

- Market-based loans are used when availability of funds (liquidity) is an issue but there is no need to subsidise the project with concessional financing. These loans help to overcome the liquidity barrier

- Grants are better suited for smaller and focused funding situations, such as financing novel technologies, project development, policy support, capacity building and education. Grant finance is essential for building a pipeline of bankable projects, helping projects reach a level of maturity that might attract investors, and launching pilot projects.

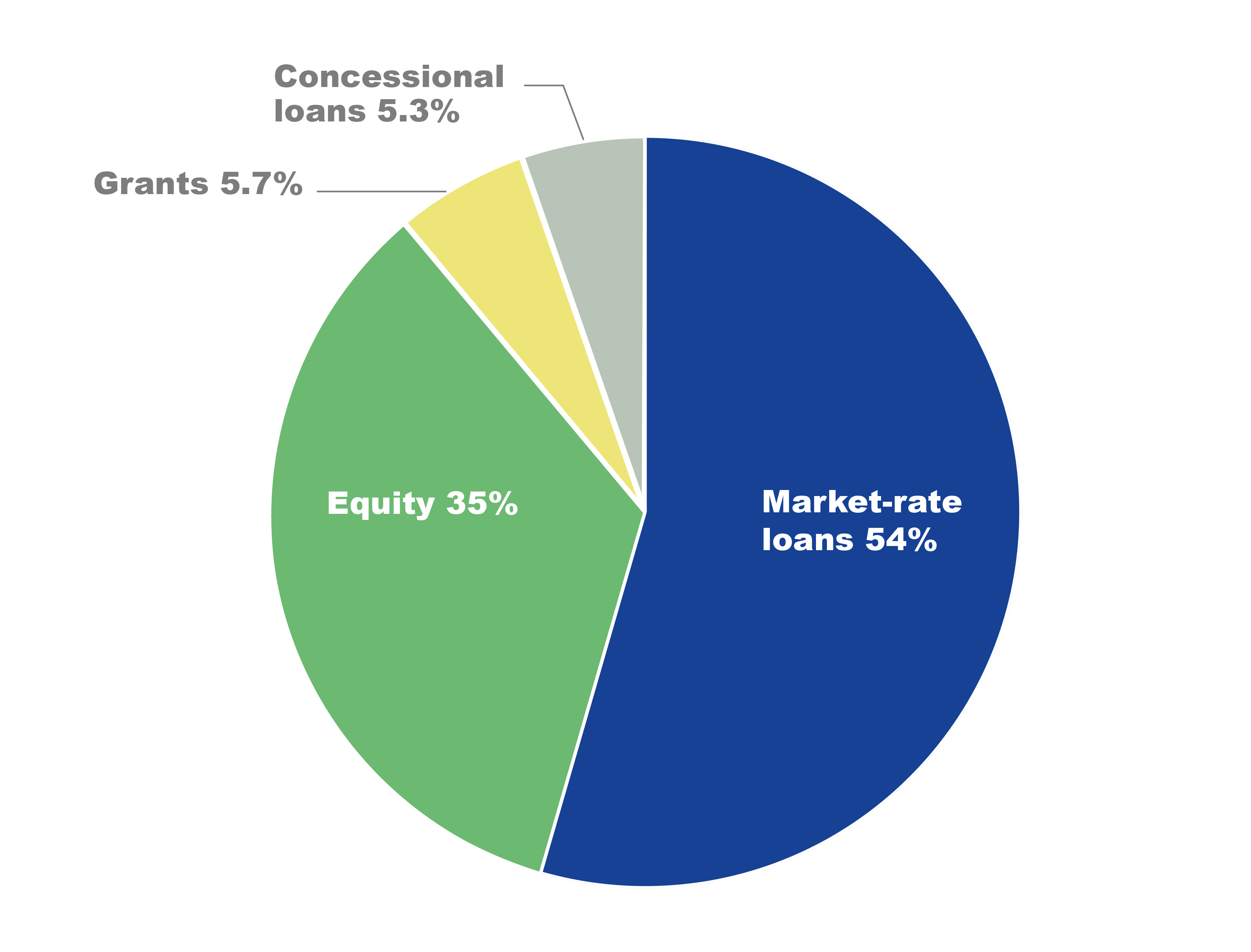

The use of financing instruments is as follows:

- Loans are the dominant instrument with around 60% of the global climate finance universe

- Within the debt financing segment, market-rate loans command over 90% of all loans provided

- Concessional finance (grants and concessional loans), which is the vital component of climate funding in the developing countries, comprise only 11% of total financing (see Figure 4)

- Scarce concessional finance – most often provided by governments and multilateral, bilateral or national DFIs – is not making its way to less mature markets, which means the energy transition is not able to advance in many developing countries.

Figure 4: Breakdown of global climate finance by instruments in 2022 (total of USD 1,415 billion)

Source: Climate Policy Initiative