Sources of financing

The four basic sources of funding are:

- Public

- Private

- Domestic (national)

- International

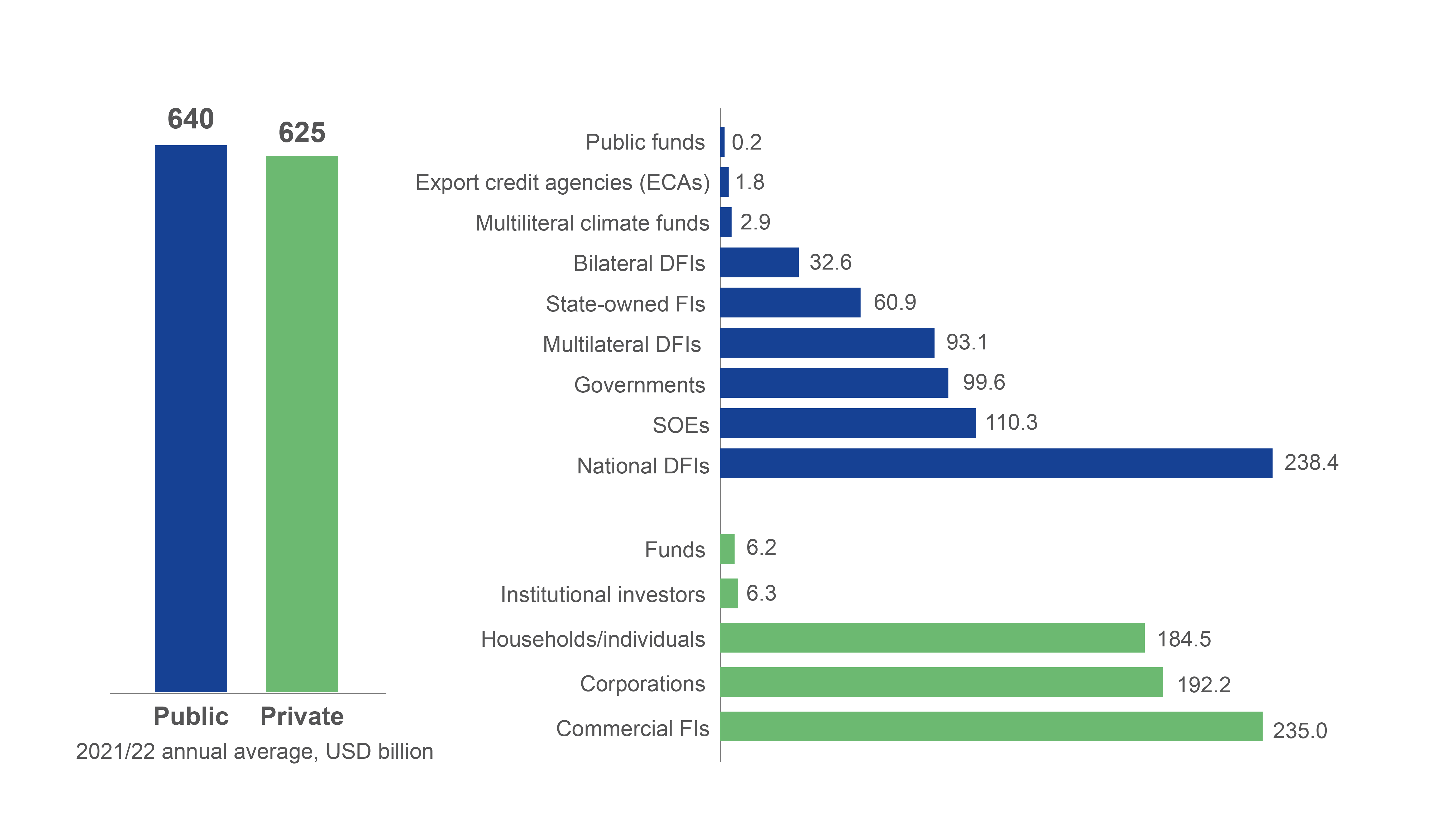

The detailed breakdown of financing sources globally is shown in Figure 5.

Figure 5: Sources of public and private climate finance (USD billion)

Source: Climate Policy Initiative

Source: Climate Policy Initiative

DFIs = Development finance institutions; FIs = Financial institutions; SOEs = State-owned entities

The strategic use of public finance is essential as it helps create an enabling environment for private investors, by developing infrastructure and addressing the risks and barriers that deter private capital. Public funding also facilitates capacity-building, education and retraining, which are important components of energy transition.

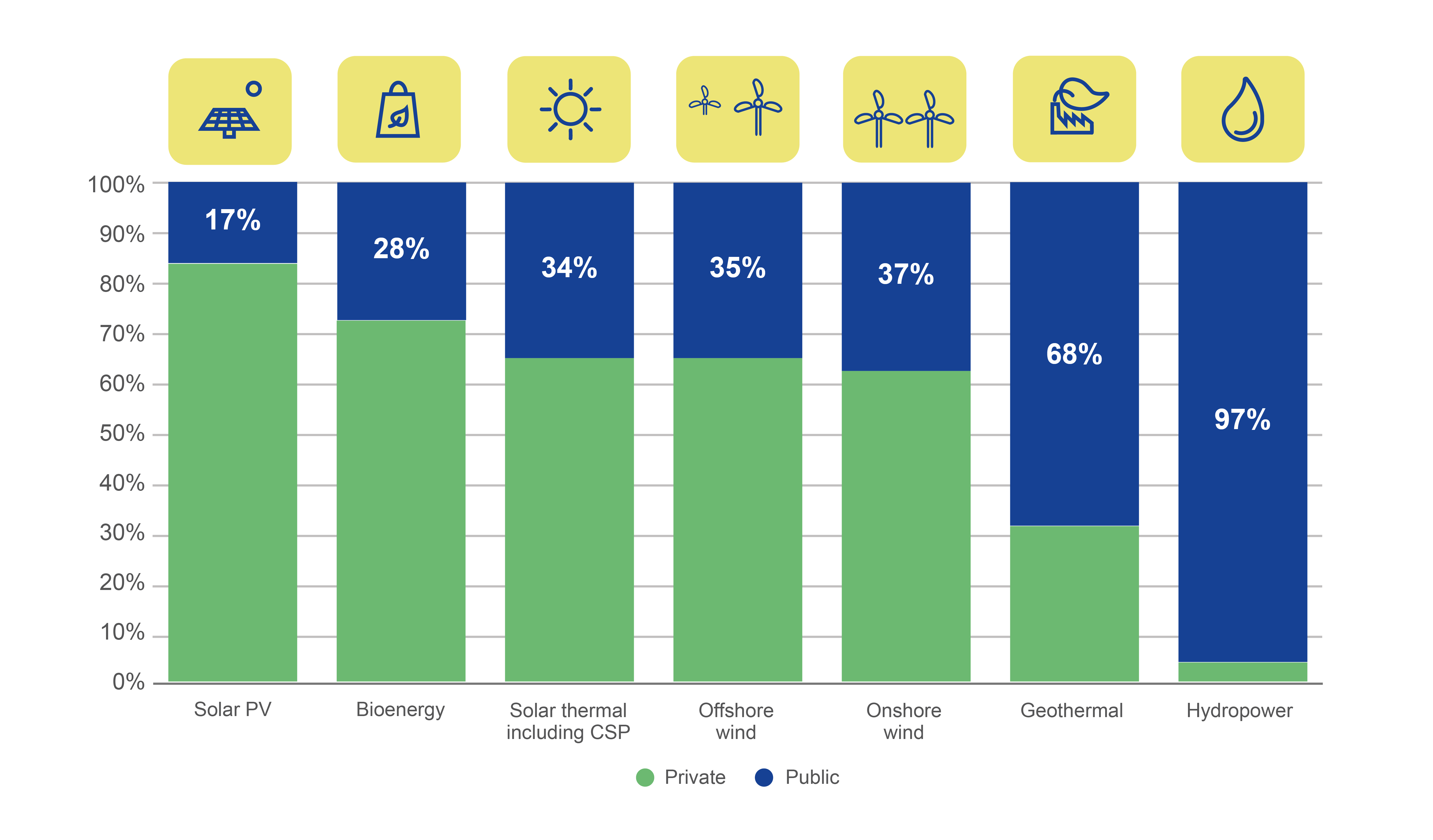

In RE space, the private sector provides around 2/3 of financing for RE investments. The share of public versus private investments varies by technology (see Figure 6). Typically, lower shares of public finance are devoted to RE technologies that are commercially viable and highly competitive, which makes them more attractive for private investors. In 2020, 60-83% of solar, bioenergy and wind investments were financed by private sector. While geothermal and hydropower received the largest shares of public finance in 2020.

Figure 6: Share of public/private investments by RE technology, 2020

Source: IRENA

Source: IRENA

The order in which different sources of energy transition finance are leveraged in developing countries is important. It is recommended that the public sector should come first, in order to inspire private sector investment. The national public sector usually starts finance raising, by presenting its policy ideas and potential budget funding commitments to international donors, before it starts securing financing from domestic and then from international private players. This proposed order of finance leveraging is illustrated with arrows in Figure 7 below.

Figure 7: The order of finance raising for energy transition investments