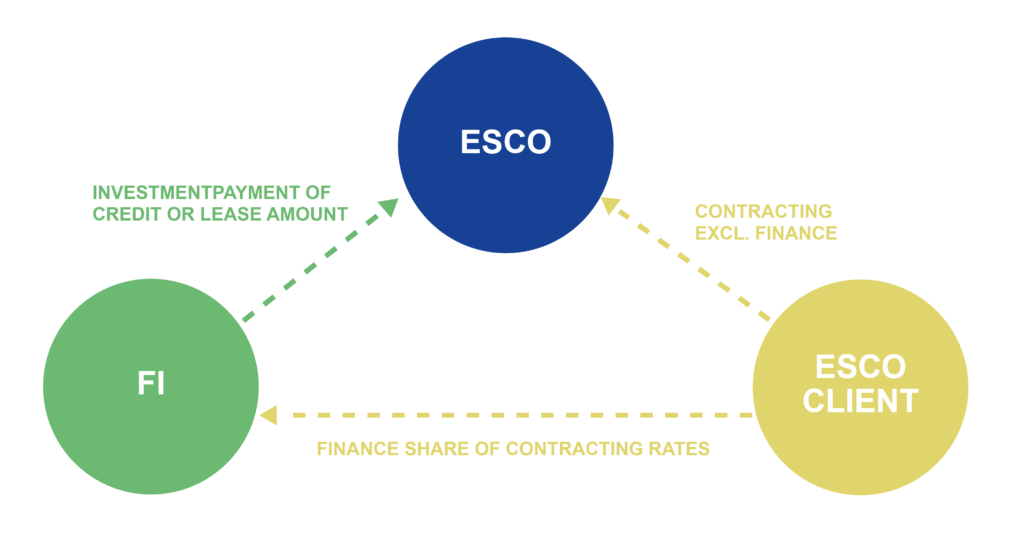

Cession of contracting rates as security for credit- or lease-finance

Assigning contracting rates in this context is not a standalone financing method but can function as additional collateral for the financial institution (FI), potentially streamlining cash flow management.

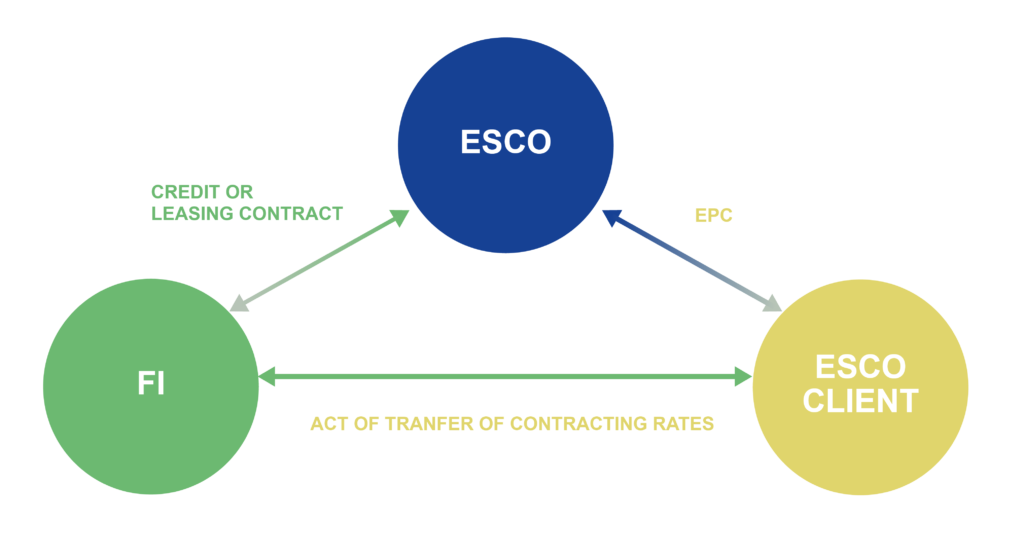

Through a legal transfer (cession), the ESCO’s claims against the client are assigned to the FI. Consequently, the client remits the designated portion of the contracting payments directly to the FI, which then applies these funds to reduce the ESCO’s outstanding debt.

A garnishee agreement serves as an additional layer of security for the financial institution (FI), particularly when the assigned contract payments are required to be settled by the client, regardless of whether the Energy Performance Contract (EPC) is fully executed (non-recourse or waiver of objection).

ESCO clients are not obligated to assign the entire contract payment. A practical approach might be to assign an amount equivalent to the investment and capital cost portion of the contract rate. The remaining portion, which covers operations, maintenance, and associated risks, would still be paid directly to the ESCO.

From the ESCO’s perspective, it is beneficial if the FI agrees to take on certain risks under the garnishee agreement, such as the financial performance risk of the ESCO client. In this scenario, “non-recourse” indicates that the FI waives the right to claim against the ESCO, provided that the ESCO has met its contractual obligations, including the guaranteed energy savings outlined in the EPC (addressing technical performance risks).

The relationships between the three parties – ESCO, client, and FI – in the context of assigning payments as security for credit or lease financing are illustrated in the accompanying diagram.

Different types of receivable assignment include open, partially open, and concealed assignments, which vary based on the level of disclosure to the ESCO client. An open assignment involves full transparency where the client is informed and has agreed to the transfer of liabilities. A partially open assignment might involve some level of client awareness without full agreement, while a concealed assignment is a private arrangement between the ESCO and the financial institution, occurring without the client’s knowledge or consent.