Credit financing

Credit (or loan) financing means that a lender (Financial Institution – FI) provides a borrower with capital for a defined purpose over a fixed period. Borrowers in that case can be either the ESCO or the ESCO Client. A credit is settled over a fixed period, with a number of fixed instalments (debt service). These instalments must cover the amount borrowed, plus interest rates, as well as other transaction costs such as administrative fees. Loans are disbursed against proof of purchase in order to secure the earmarked use of the funds.

Credit serves in fact as an extension of the total amount of capital that an enterprise can use to do its business, i.e., deliver services. Credits are also referred to as committed assets or loan capital.

Credits require a creditworthy borrower. This means that credit has to be backed by the ability of the borrower to perform the debt service. It is assumed that this ability is linked to a certain level of equity capital, typically 20-30 % of the loan. The creditworthiness of a borrower (together with the project chances and risks) will be reflected in the number of securities needed to cover the lender’s risks associated with handing out credit. Where public entities are debtors or in cases where credits are backed by public entities, credit ratings are generally high.

The borrower is both the economic and legal owner of the investment made with a loan. Therefore, the investment is capitalized on its balance sheet which, in return, downgrades its equity-to-assets ratio. A reduced share in equity means less capital to do business with and a reduced ability to get further credits (credit lines).

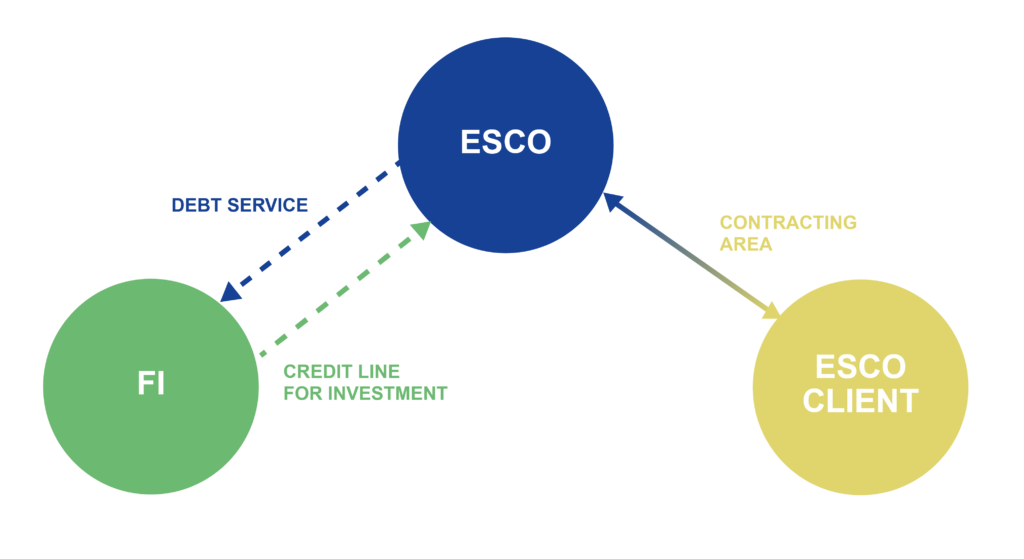

Another factor that influences the borrower’s possibilities to receive credit is the fact that the clients are evaluated by international uniform criteria and divided into classes, which declare creditworthiness. It is expected that credits will be more difficult to obtain and that they will cost more, especially for SMEs. The following graphs visualize the basic cash flow relationships for typical credit finance.

The cash flows depend on whether the ESCO or ESCO Client is the lender for the credit. The cash flows depend on whether the ESCO or ESCO Client is the lender for the credit. Figure 5 shows the former case, Figure 6 the latter.

Comments to Figure 5:

In the model depicted in Figure 5 , the Energy Service Company (ESCO) undertakes Energy Conservation Measures (ECMs) and Renewable Energy (RE) projects, financing the necessary investments through a credit line. The ESCO’s client pays a contractual fee, which includes a portion allocated for financing, contingent on the ESCO meeting its guaranteed energy savings targets

The ESCO utilizes this contractual payment to service its debt obligations. Additionally, the ESCO has the option to transfer the financing component of the contractual payment directly to a financial institution (FI), allowing the ESCO’s client to repay the debt directly. This setup represents a conventional ESCO-third-party financing arrangement. However, it is important to note that while this model is widely used, it may not always represent the most optimal financing solution depending on specific project circumstances and market conditions.

This is the “traditional” ESCO-third party-financing model, which is not always the optimal financing solution.

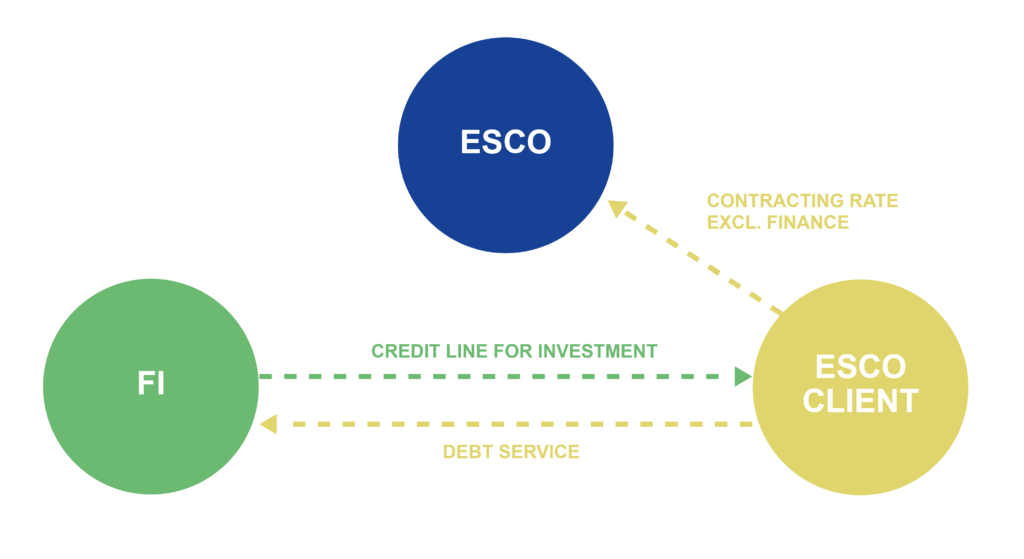

The next figure displays the ESCO Client as lender of the credit:

Comments to Figure 6:

- The ESCO is responsible for the implementation of the ECMs & RE

- The EE-investment is paid out of the ESCO Client’s credit line

- The customer payments for the investment can be the remuneration of an equipment supply contract (in this case, VAT is due on the complete investment at once)

- This model is advisable if the ESCO client has better financial conditions than the ESCO

In practice, a collaborative financing approach involving both the ESCO and the ESCO Client is often preferable and advisable. In many instances, the ESCO Client can contribute to the financing through subsidies, funds allocated for maintenance reserves, or by providing a portion of equity capital. This shared financial responsibility helps to align the interests of both parties and can make the overall project more viable and attractive.