Leasing financing

Leasing provides a method for obtaining the right to use an asset without owning it. In the context of energy efficiency (EE) investments, which include Energy Conservation Measures (ECMs), Renewable Energy (RE) installations, or energy supply plants, leasing allows entities to utilize these assets by paying for the right to use them, rather than purchasing them outright.

Leasing is a contractual agreement between the asset owner (lessor) and the user (lessee), where the lessor grants the lessee exclusive rights to use the asset for a specified period, known as the basic lease term, in exchange for regular lease payments. These payments, often made as annuities, are paid to the leasing financial institution (LFI). The lessee could be an Energy Service Company (ESCO) or the ESCO client (the asset owner), as illustrated in the following examples.

The two main types of leases relevant to Energy Performance Contracting (EPC) are operating leases and finance leases. The fundamental contractual relationships within a leasing agreement are illustrated in the accompanying figures.

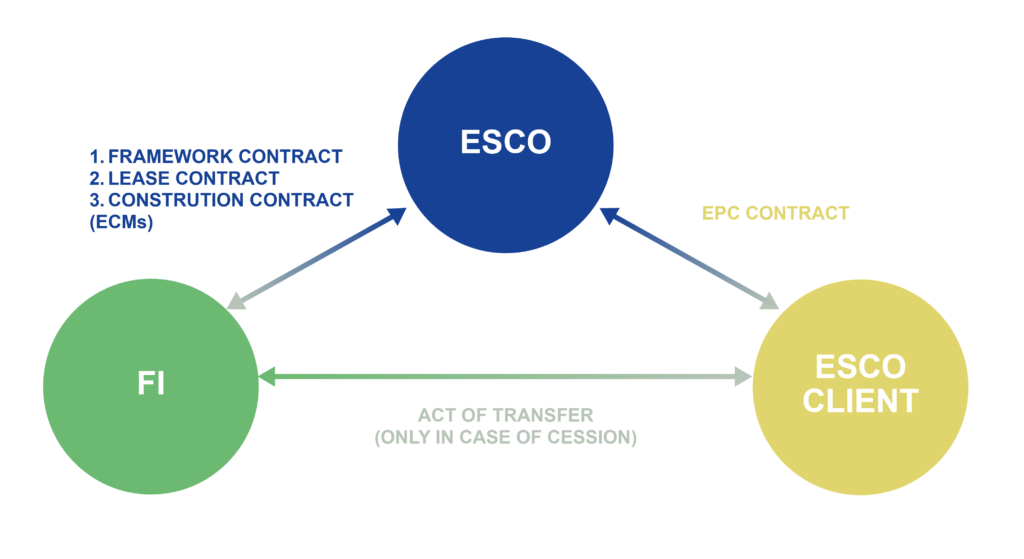

| Figure 7: Contract relationships of a leasing agreement

with the ESCO |

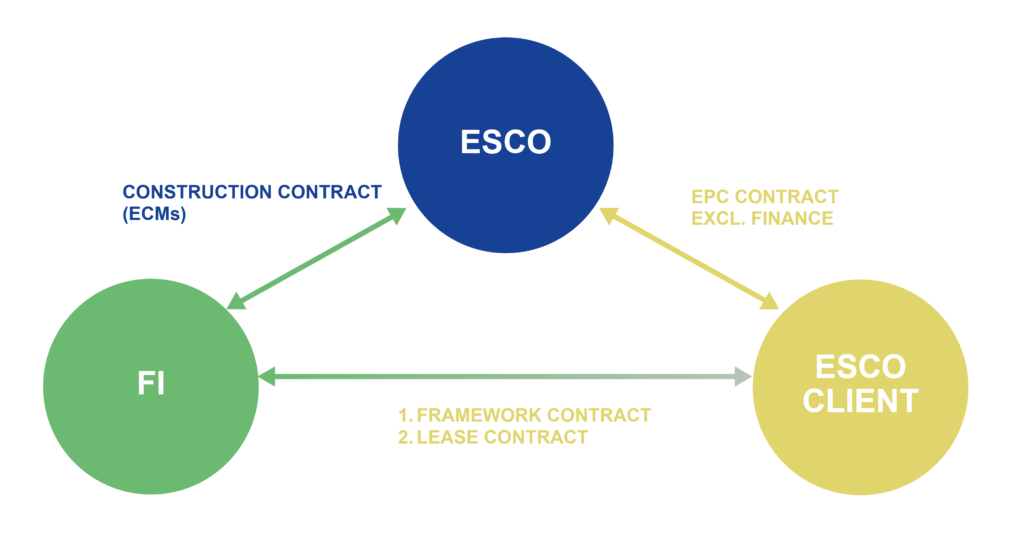

Figure 8: Contract relationships of a leasing agreement

with the ESCO Client |

|

|

Comments to the figures:

- The ESCO is responsible for implementing the Energy Conservation Measures (ECMs) and assumes the associated technical, economic, and organizational risks involved in the Energy Performance Contract (EPC). Additionally, the ESCO often facilitates the financing required for the project.

- The Financial Institution (FI) manages the financial and administrative aspects of the project, bearing the related risks. The FI may enter into a framework and lease agreement either directly with the ESCO (sometimes involving a cession agreement for a portion of the contracting fees) or with the ESCO Client.

- The FI also enters into a construction contract with the ESCO for the execution of the ECMs.

Leasing models can be categorized based on how the financing is structured, particularly regarding the amortization of the leased asset. These include full-amortization contracts, where the total cost of the asset is covered over the lease term, and part-amortization contracts, which involve a residual value that remains at the end of the lease period. Additionally, leasing agreements may or may not require advance payments, with both options being viable for financing Energy Performance Contracting (EPC) projects.

Sale-and-lease-back arrangements are commonly utilized for financing comprehensive building renovation projects, beyond just the scope of EPCs. This approach allows entities, such as public institutions, to leverage existing assets by monetizing “hidden reserves” in their facilities. To ensure that such projects meet energy efficiency goals, it is advisable to establish minimum performance standards for thermal upgrades and to include guarantees—such as limits on energy consumption—within the project’s terms of reference.

The typical cash flow relationships of a leasing agreement are displayed in the following two figures.

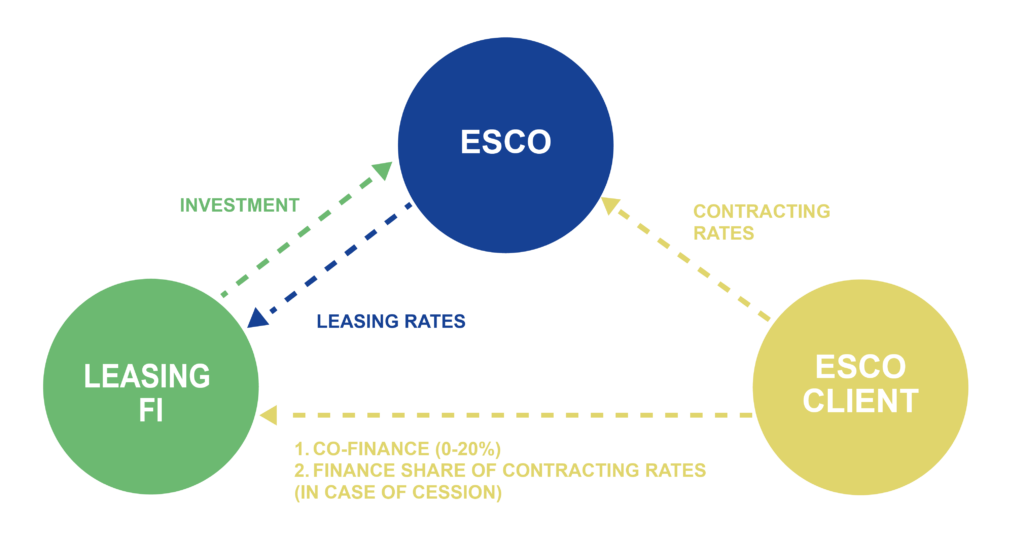

| Figure 9: Cash flow relationships of a leasing agreement

with ESCO |

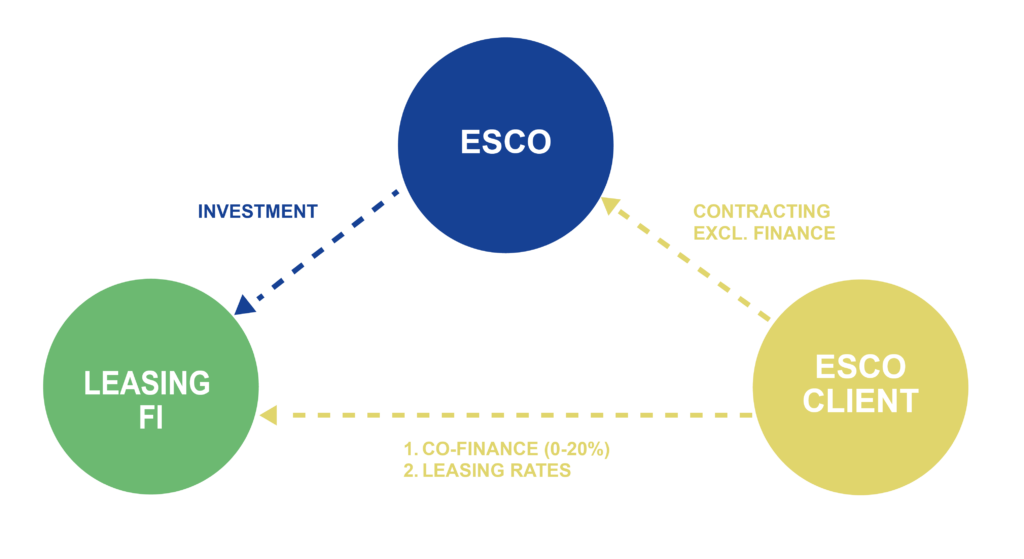

Figure 10: Cash flow relationships of a leasing agreement

with the ESCO Client |

|

|

Comments on the figures:

- Role of the leasing Financial Institution (FI): In both scenarios, the Leasing FI is responsible for financing the Energy Conservation Measures (ECMs) while the ESCO handles the implementation and arranges the necessary financing agreements.

- Co-financing: The Leasing FI should also manage any co-financing arrangements, such as subsidies, that may be available to support the project.

- ESCO financing: If the ESCO is responsible for financing, the portion of the ESCO’s claims related to financing can be assigned to the FI. This allows the FI to directly handle the repayment of the ESCO’s debt.

- ESCO client financing: When the ESCO Client is financing the project, the share of the payment related to financing is paid directly to the Leasing FI as a leasing fee. The remainder, which covers operations, maintenance, and asset costs, should be paid directly to the ESCO.

Advantages of operating lease in EPC:

- The operating lease model provides several benefits to the lessee, such as off-balance-sheet financing due to the lessor’s capitalization, access to extended credit lines, and lower transaction costs.

Potential drawbacks:

- Only assets that qualify as leasable goods can be included.

- Early termination of the contract can result in disproportionately high costs.

- Despite leasing obligations not appearing on the balance sheet, they must be disclosed to potential creditors as pending liabilities.

Additional considerations:

- Financing term: For a lease to qualify as such, the lease term must not exceed a certain percentage of the asset’s useful life (e.g., 90% in Austria and Germany, 75% of economic life under US GAAP). According to IFRS principles, applicable in Moldova, depreciation is provided over the lease term or the asset’s useful life, whichever is shorter.

- Eligibility for financing: Not all investments in energy supply and ECMs are suitable for operating lease financing. The concept of fungibility or interchangeability of an asset (as required by tax laws) determines whether it qualifies for operating leasing. For instance, a containerized combined heat and power plant may qualify due to its portability, while building insulation would not. Generally, at least 80% of the total investment needs to be fungible to qualify.

- Practical application: Many EPC measures do not meet the criteria for operating leasing, whereas Supply Contracting measures might. There is, however, some interpretative flexibility, and certain Leasing FIs may adopt more creative approaches than others.

- Ownership structure: In an operating lease, the lessor retains both legal and economic ownership of the asset, while the lessee is granted exclusive usage rights in exchange for a predetermined leasing fee.

- Finance lease: A finance lease is essentially a hybrid between traditional credit financing and an operating lease, offering a mix of both arrangements.